Unlike resale condominiums, the process of buying a pre-construction condominium can be very different, using different industry jargon and at a much faster pace. During the buying process, you want to make sure that you ask all the right questions and fully understand all of the worst-case scenarios. I always prefer to ask hard or difficult questions in advance, so there are no surprises. As well, with the major influx of non-local buyers, investors, and builders, pre-construction condominium buying is constantly changing. Assignments, development fees, etc, are two examples that were not a major topic of discussion a few years ago. Our job is to foresee possible issues and avoid all or as many as possible! Use this list to ask the builder or builders salesperson when you are looking at buying a pre-construction condominium in Ottawa.

- What are we able to negotiate?

I usually will start with this question when I have a new builder or new sales staff that we are not familiar with. An open-ended question that I expect will be met with a blank stare and a “Ummm, nothing sir”. While it is very common that builders will not negotiate, I usually want to see if they are, and if so what are we able to negotiate. Some builders have some room in their price, others will not touch the price but are able to negotiate the deposit, inclusions, parking price…. Some will even throw in a free storage locker. Even if the builder says no, often they are still open to negotiations in some other way. Every builder, building, and project launch will be different - asking on opening day if you can get the price down, when there is a line around the block, probably isn’t very likely.

- Can we amend the deposit structure?

Often the deposit structure is laid out very straightforward - typically 20% that is split amongst set dates/timelines. For example: X amount to hold the unit until you do the paperwork, X amount when you sign the paperwork, X amount in 30,90,120 days, X amount on occupancy. Some builders will allow these dates to be shuffled around, while some will allow an overall lower deposit percentage. The closer the project is to be finished, you might find a deposit as low as 5% or even less!

- Will you allow me to assign? If so, how much will it cost?

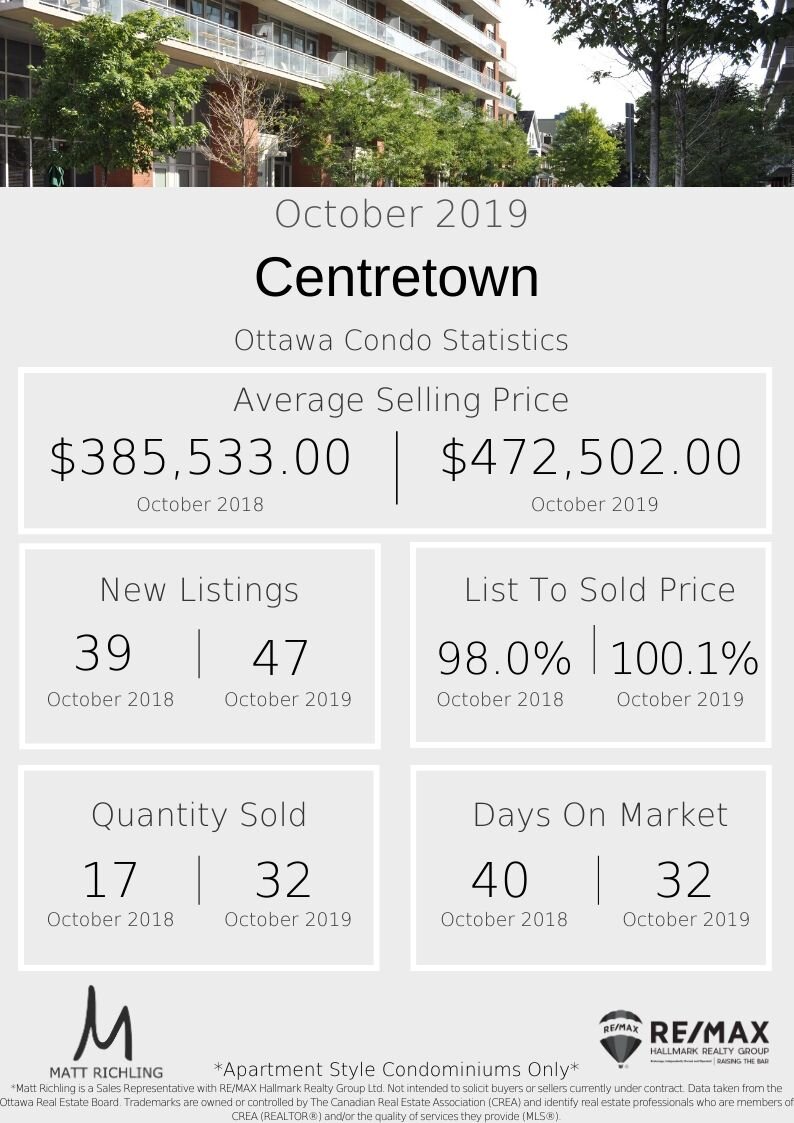

Assigning a pre-construction condominium is somewhat new to the Ottawa condo market. While it has been around for years (decades), it has only started to gain popularity with buyers and builders who are coming over from Toronto. In Toronto, the market has seen such crazy up-swings that pre-construction condo buyers are assigning their condo before closing and able to make $200-300,000 or more - hence why it is so lucrative. Typically for these very complicated assignment deals to take place, the builder will allow it for a fee. We have seen low rates of a couple thousand, up to $10,000 plus a lawyers fee of a few thousand.

However, many Ottawa builders have not yet caught on, and are not allowing assignments period. Some smaller Ottawa builders have allowed it later on in the cycle if a certain percentage or certain model are all sold firm. The builder is worried that they will have to also compete with you, trying to sell your unit.

Tip: Request to include a clause in the agreement that allows you the right to cancel the sale if injury, unemployment, or other drastic circumstances prevent you from closing. This could save you tens of thousands of dollars down the road.

- What are your outside Tarion dates?

Every agreement includes the Tarion Statement of Critical Dates which will outline the important dates regarding your condo and the project. These dates include the tentative occupancy date and the outside occupancy date, which make up the current projected date that the builder will expect your property to be completed and ready to move in, along with the latest date by which the builder agrees to provide the occupancy. From a recent project as an example, the tentative occupancy date at the time of signing the agreement was September 1st, 2023, while the outside occupancy date was set as September 1st, 2026. When you are trying to plan this far ahead, it is always a good idea to know the worst-case scenarios. The same form also includes the termination period date, which is 30 days after the outside occupancy date. This date would allow the buyer the ability to a full refund of monies paid plus interest, and delayed closing compensation.

- What is not included in the price?

Builders are constantly looking for ways to lower or pass on costs to the buyer. While still relatively new in Ottawa, we are seeing builders (Toronto builders especially) pass on closing costs, municipal levies, and development fee’s to the buyer. Often these amounts are unknown until the unit is officially registered and you close on the property, however, they can easily add up to 1-3% of the original purchase price. In our experience, the sales staff might not acknowledge these, and it is always best to also ask your lawyer during your cooling off period when they are reviewing the agreement. While they are not listed out specifically in the sales agreement, they are mentioned.

- Can we cap the development fees, municipal levies, and/or closing costs?

While these “hidden” costs can be a large turn off for many buyers, many builders are willing to cap a limit to how much they will be at closing. Recently some builders have been willing to cap the entire amount, while others are willing to cap them at a set amount. Ensure you are clear with your lawyer and the sales staff when negotiating as we recently had experience where a builder advertised that it was willing to “cap development charges at $5,000”, however, what they were capping was only a portion of the fee’s and the amount they were willing to cap for all of the closing costs/development fees was $10,000. Keep in mind that this was a building that we were expecting the fees to be closer to $20,000 without a cap in place.

- What is and is not included in the monthly condo fee?

Always make sure to ask what is and isn’t included in your monthly condo fee. Knowing in advance that the builder will be sub-metering something that you didn’t expect can change how you look at the costs. For example, that the water is not included, or that the heat is actually a heat pump and the heating is not included. While usually well explained, it should be noted that if you add a parking spot or storage locker, your condo fees will typically increase as well. These extra charges can add up and change your monthly costs which is always wise to know in advance.

- Does this purchase qualify for the HST New Housing Rebate? Or is the HST rebate factored into the price?

It is always a good idea to ask the salesperson if the HST New Housing Rebate is factored into the sales price. Most of the projects are, and if you are an end-user (you plan on living in the unit), but the fewer surprises at closing the better. Keep in mind that there is a different rebate if you are an investor (planning on renting out the condo), but it is required that you pay the HST upfront at closing and then apply for the rebate after the fact. HST rules are so confusing that we are seeing specialty companies who are specifically focused on assisting buyers and investors with getting the rebate etc. Regardless if you are an end-user or investment, we suggest that you get legal advice to ensure there are no surprises.

- What is their typical period between Interim Occupancy and the Closing?

When your unit is ready, the builder will tell you that you have to move in, a period called Interim Occupancy. You have not yet closed (taken legal ownership) on the property, so instead of paying your mortgage, condo fees, and property taxes, you will pay the builder an Interim Occupancy fee. For more information on Interim Occupancy, view a post we did here which fully breaks it down and explains everything.

Typically you can expect a period between Interim Occupancy and the Closing to be anywhere from a month up to two years. Knowing in advance what the builder’s past history of the period is, can certainly help you plan moving forward. As an example, an Ottawa builder had advertised that it had a zero-day interim occupancy period on its last few projects.

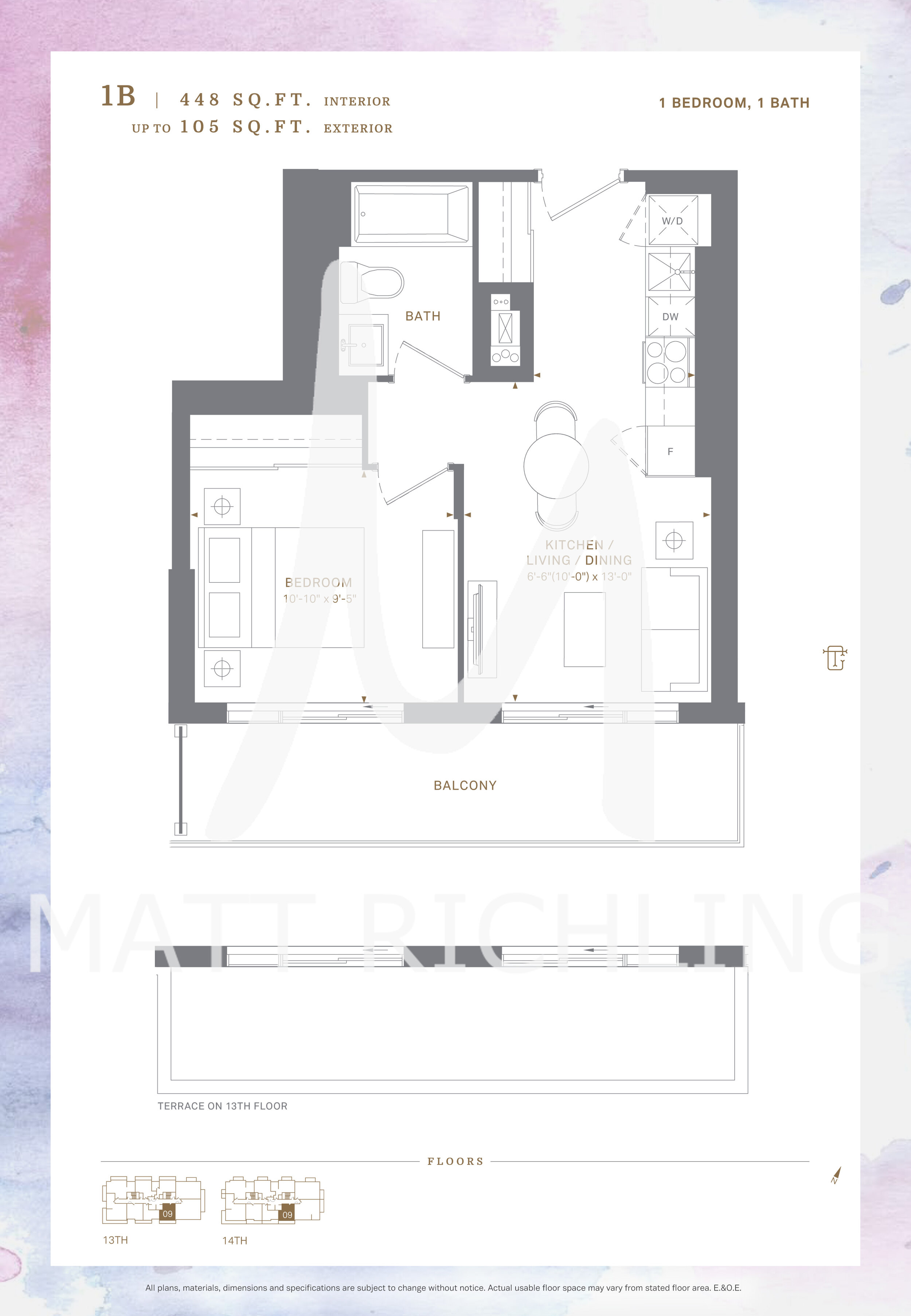

- Will my view be obstructed, what is the chance that the view will change?

Typically, one of the most important features that you are looking for in a condo is a stunning unobstructed view. The last thing you want to find out is that your perfect view is actually facing another building. Ask your agent or the builders salesperson what are the chances of your view changing. Any vacant lot, parking lot, zoning amendment sign, or even just a zoning amendment application could signal a possible future building. Even heritage properties are not off-limits and we always suggest asking more questions and doing research with the city.

If you are thinking of buying pre-construction condos in Ottawa and would like to chat more about your options, fill out the form below.