Every month we take a closer look and drill down the sales data of Ottawa condos from the previous month. Here are the statistics for March 2025 in the top five "downtown" areas - Centretown, Byward Market and Sandy Hill, Little Italy (which includes Lebreton Flats), Hintonburg, and Westboro. The information will be specific to apartment-style condominiums, and only what is sold through the MLS. Also important to note that DOM (Day's On Market) is calculated to include the conditional period, which in Ottawa is roughly 14 days for almost every single transaction.

The Ottawa real estate market continues to show signs of cautious stability as the spring market begins to bloom. According to the Ottawa Real Estate Board (OREB), 1,103 homes were sold through the MLS® System in March 2025—a 6.2% dip compared to the same time last year. While still down from historical averages, this figure points to a market that's finding its footing amidst economic uncertainty and lower interest rates.

“The Ottawa housing market in March 2025 remained relatively stable, with sales activity slightly lower than the same period last year,” said OREB President Paul Czan. “However, we’re seeing continued momentum month-over-month as the spring market gains traction.”

Sales Activity: Still Slower, But Stabilizing

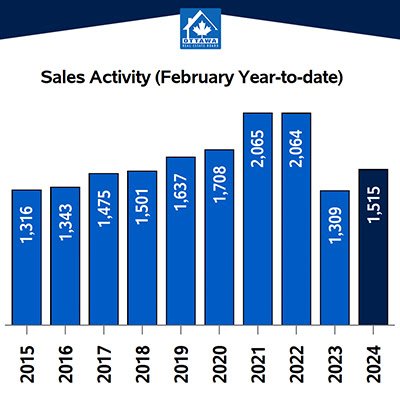

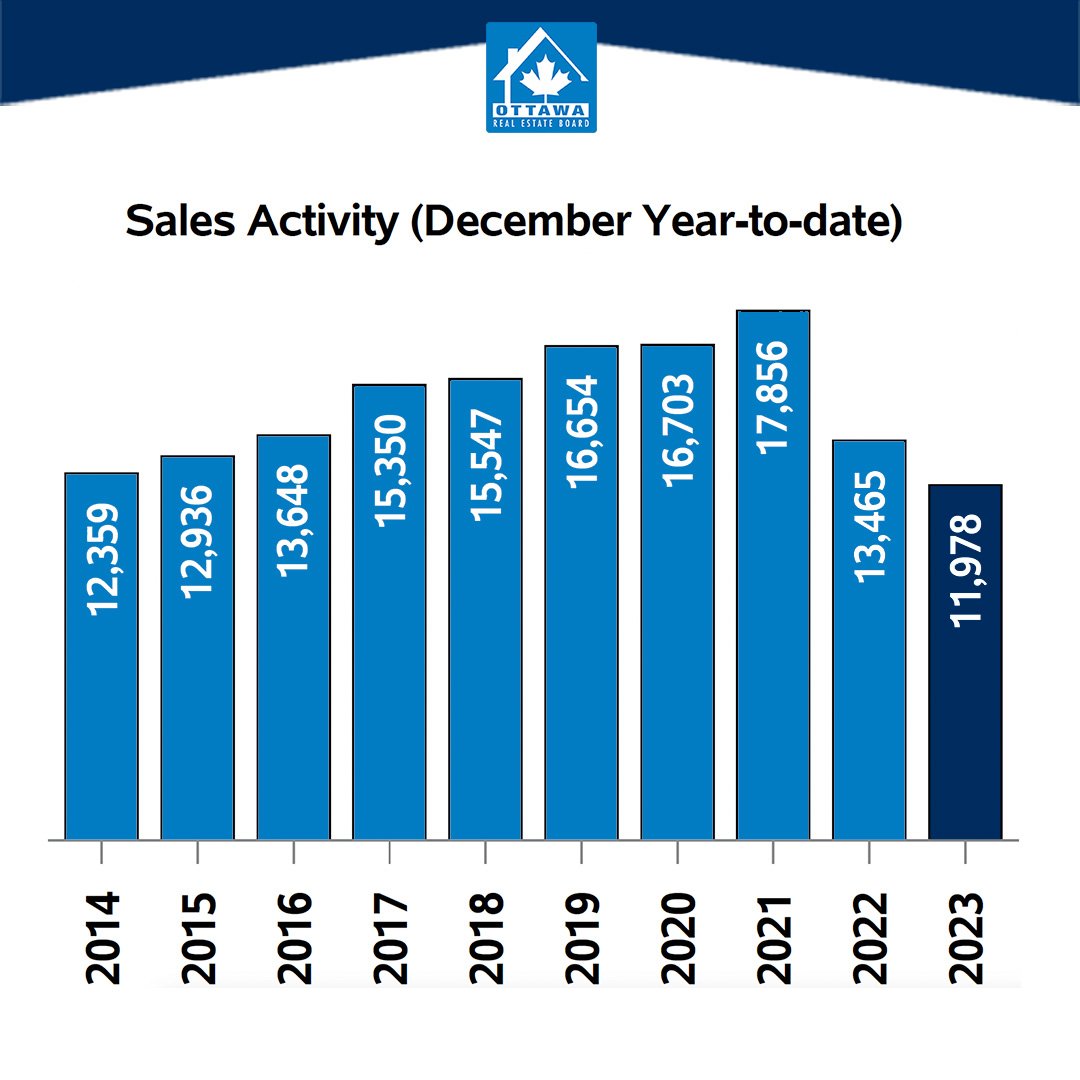

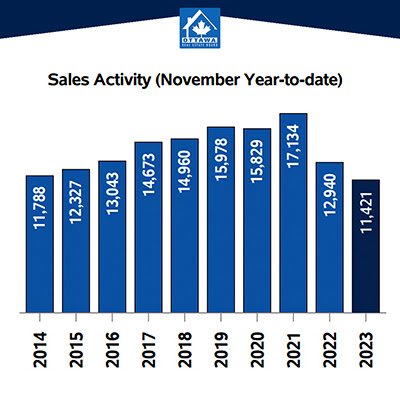

Sales activity across Ottawa remains subdued compared to recent years. As of March 2025:

Total sales YTD: 2,621

That’s down from 2,721 in 2024 and well below the pandemic highs of 4,170 in 2021 and 3,967 in 2022.

Compared to the five-year average, home sales were down 24%, and 19.3% below the 10-year average for March.

This represents the third consecutive year of March sales under 3,000, indicating a more balanced pace in the market. Many buyers and sellers are still exercising caution due to broader economic concerns and the upcoming election, but lower interest rates are gradually drawing more people back into the market.

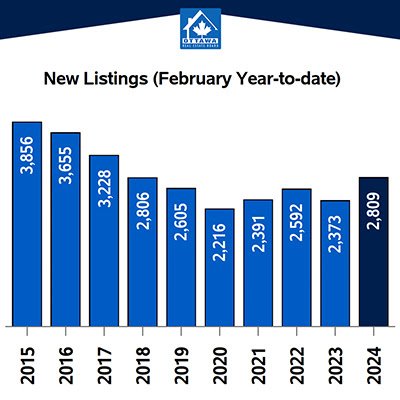

Inventory Is Growing — Fast

One of the most notable shifts this year has been the rapid rise in available inventory. As of March 2025:

Active listings: 3,769 (up from 2,372 in 2024 and 2,027 in 2023)

New listings: 2,221 (a 4.1% increase from 2024)

Months of inventory: 4.3 — up from 2.6 last year and the highest level since at least 2019

This marks a 60.3% surge in active listings compared to the same time last year, giving buyers more choice and putting slight downward pressure on competition.

OREB President Paul Czan highlighted how ongoing trade and tariff concerns may continue to affect new construction and supply:

“It’s critical that the City of Ottawa continues collaborating with key stakeholders. We were pleased to take part in discussions around the proposed New Zoning By-Law, which prioritizes housing options and opportunities to maximize options for Ottawa’s residents.”

Prices: Modest Gains, But Condos Lagging

Despite lower sales volume, home prices are showing steady—if modest—year-over-year increases in most categories:

Overall MLS® HPI Benchmark Price: $626,200 (+2.2% vs. 2024)

Single-family homes: $698,700 (+2.7%)

Townhomes/row units: $431,200 (+3.0%)

Apartments: $400,900 (–4.3%)

This reflects a cooling of the condo market, which surged during the pandemic but may now be facing stiffer competition from more available low-rise and freehold options.

What This Means for Buyers and Sellers

If you’re a buyer, there’s more inventory to choose from and slightly less competition than in recent years. With 4.3 months of inventory now on the market, you may have a bit more breathing room—though desirable properties are still moving quickly if priced right.

If you’re a seller, realistic pricing and proper presentation are key. The rise in inventory means your home needs to stand out, but motivated buyers are still very much active.

Looking Ahead

The Ottawa real estate market is not surging, but it’s not stalling either. It’s a market in motion—balancing economic hesitations with growing buyer confidence as interest rates soften. If you're planning a move this year, whether buying or selling, the early spring numbers suggest now is the time to act before competition heats up.

Want to talk about how to navigate the current market? Let’s connect and make a plan that works for you.

Important to note is that these statistics can only be as accurate as there are condos sold in Ottawa. The more condos sold in an area, the more accurate the averages will be.

Want to chat about your options? Fill out the form at the bottom of the page, or text/call us directly at 613-900-5700 or fill out the form at the bottom of the page.

Do you have any questions about how this information affects your investment or looking for more information to make the best decision about your purchase? Let’s chat! Fill out the form on the bottom of the page.