How agents are handling (and calming) clients’ coronavirus fears

By Marian Mcpherson - Inman News - March 3, 2020

Implementing lessons from previous outbreaks in Canada

Meanwhile, in Ottawa, Canada, RE/MAX Hallmark agent Matt Richling is implementing the lessons learned during the 2003 SARS outbreak, another form of coronavirus that caused worldwide pandemonium.

“We have a bit of history because we had to deal with SARS a number of years ago,” Richling said.

Richling said he’s focused on providing clients with facts and has avoided making predictions about the virus, or how it will or won’t impact the market — the same strategy they used in 2003.

“We’ve taken the position of, ‘We really don’t know what’s going to happen,’” he said. “But we have to be prepared anyway. We can only deal with what we do know as the environment changes and go from there.”

As of March 2, there have only been 27 confirmed cases of COVID-19 in Canada. However, Richling said clients are starting to express concern about how a possible outbreak will impact the market and any buying or selling plans they may have.

“I was at a listing appointment on Sunday, and I had a client ask me, ‘What’s going to happen? How is this going to affect the market?’ That was an interesting conversation because it’s the first time I’ve really dealt with that,” he told Inman. “It wasn’t a matter of, ‘We’re all gonna get sick and we’re going to die,’ it was a matter of, ‘Could this be something that impacts our market?’”

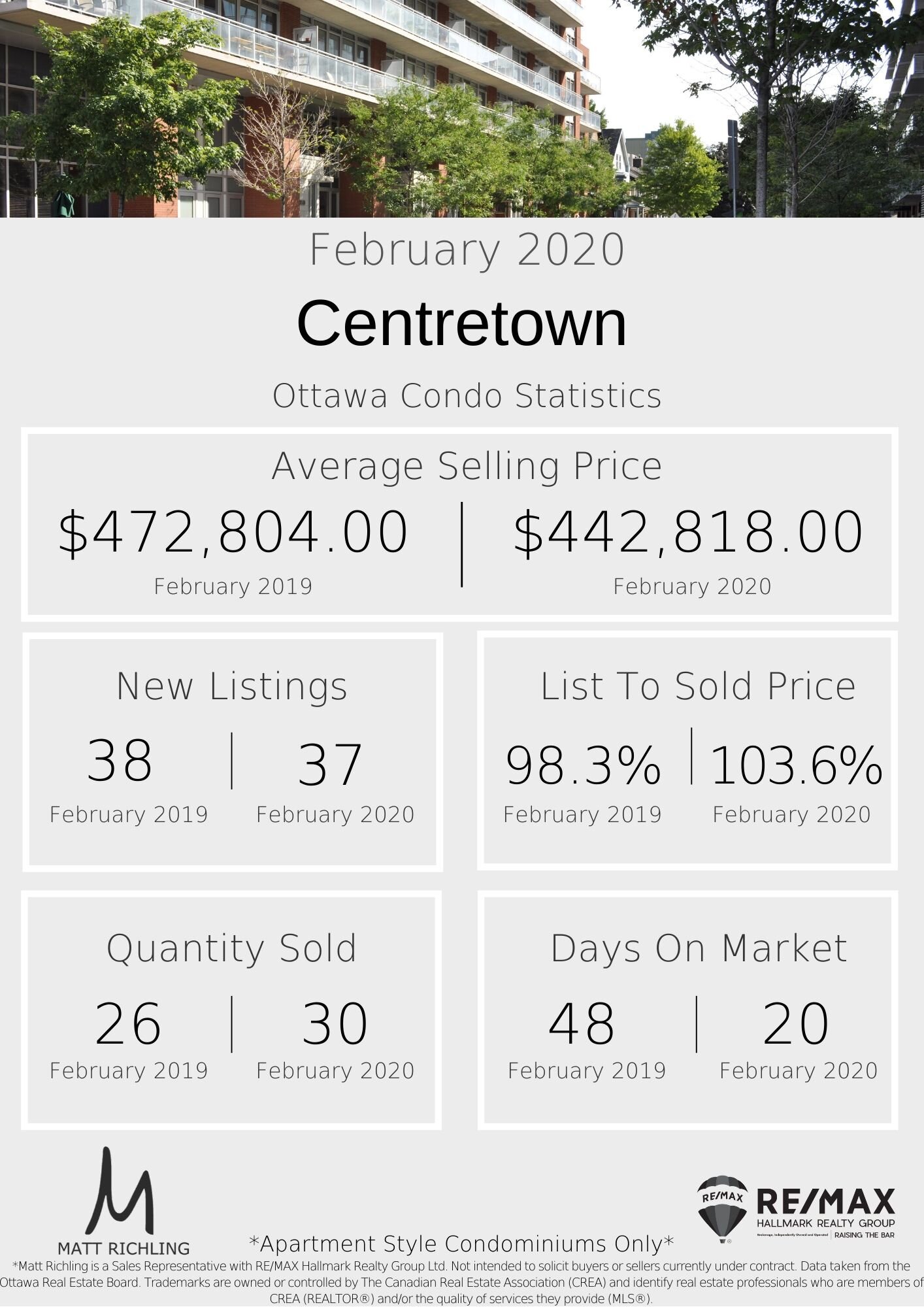

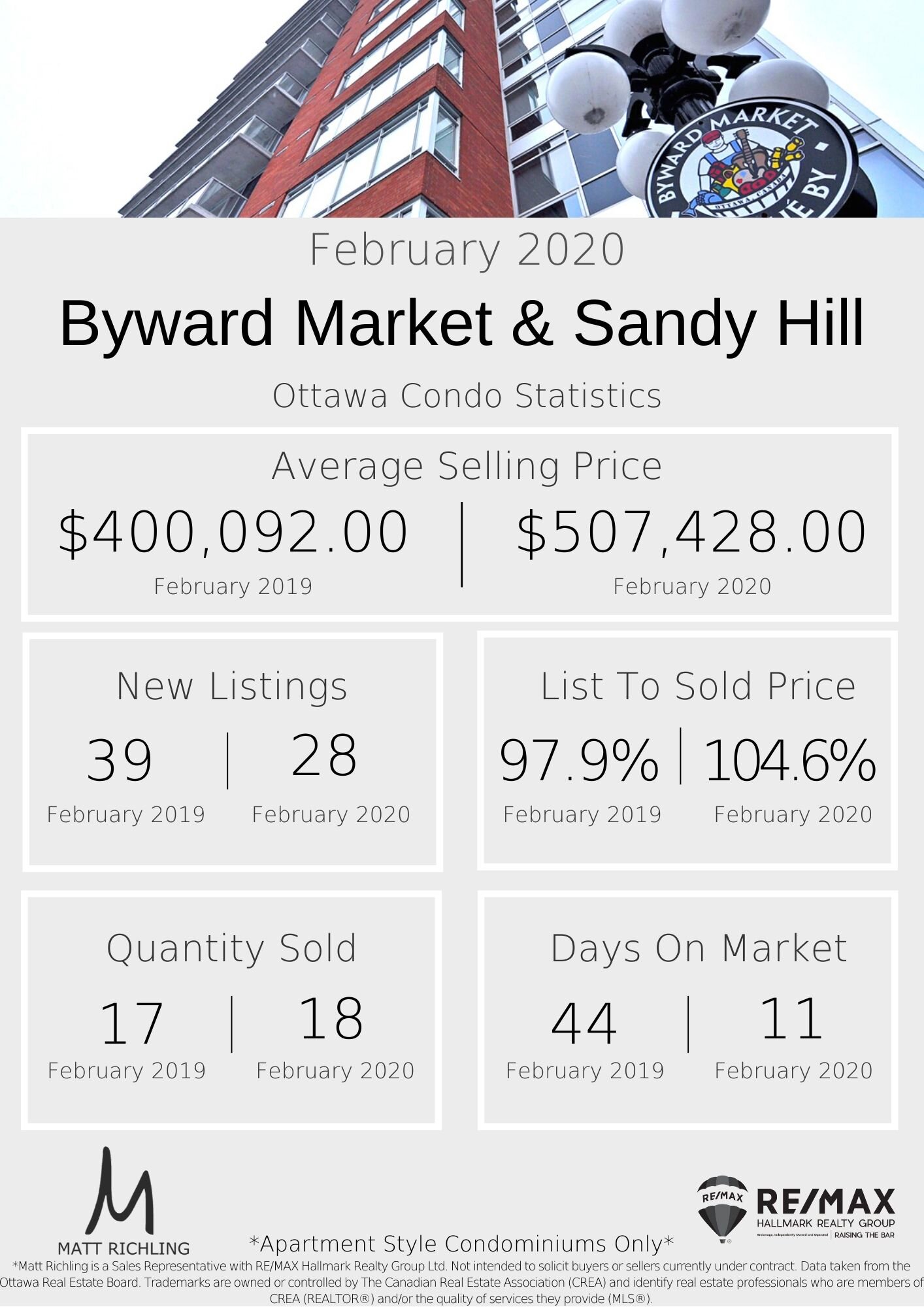

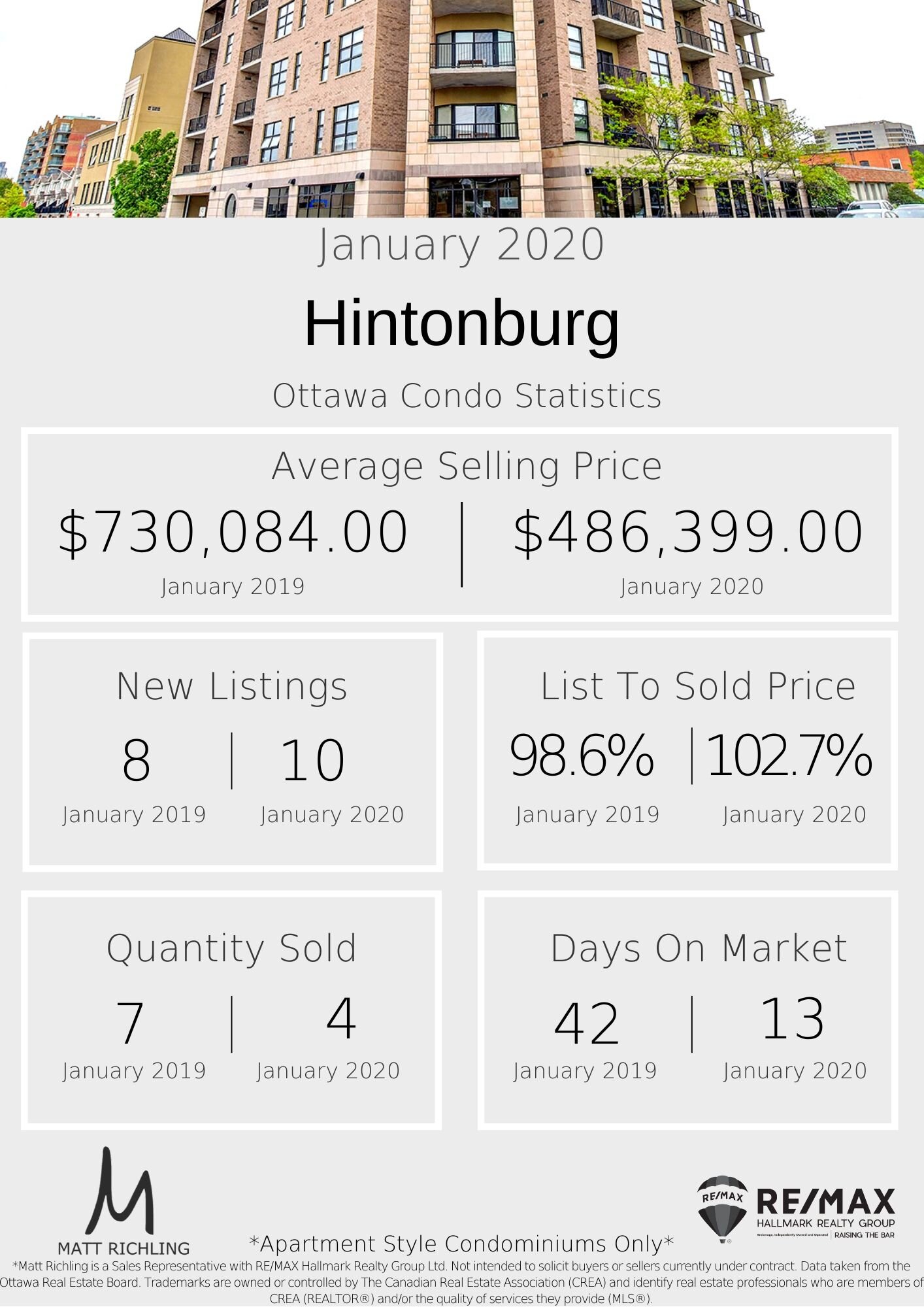

Richling said he provided a current snapshot of Ottawa’s market, which is a seller’s market with high buyer demand. Although he was able to calm that seller, Richling expects that he and his 449 colleagues will be having many more conversations about COVID-19 over the coming weeks.

“Since Sunday, it’s starting to be asked by more clients. I’m not even bringing [the coronavirus] up,” he said. “A large chunk of [my colleagues] said, ‘Yes, we’ve been dealing with questions about the virus over the past few days.'”

Even though his clients have remained relatively calm, Richling said he’s heard stories from other agents where clients have canceled moving plans to avoid open houses or have made sudden, high-dollar purchases in more remote locales to seclude themselves if the virus spreads.

“I spoke to a broker in a small town outside of Toronto, who sold a large lot and house to a couple who are doctors so they could escape if it got bad,” he said. “I mean, these aren’t even crazy doomsdayers.”

Looking forward, Richling wants his colleagues and his clients to focus on one thing: the facts.

“Agents are talking about, ‘How we can protect ourselves?’ People are reporting not being able to get hand sanitizer anywhere. Face masks have been sold out at Home Depot for two months. They get them in and they’re gone immediately,” he said.

“Because of how our industry has changed and because of how our news has changed, it’s changed how we receive information, and we have to be a little more careful of where we get our info from,” he added. “But we have to focus on the facts.”