As the real estate market in Ottawa continues to attract attention, prospective buyers and sellers are keeping a close eye on the fluctuating interest rates. We spoke with Mitch MacKenzie about the trends he’s seen in the market in terms of average selling prices and interest rates.

In this article, we'll explore the average prices over the past two years and their correlation with the target rates, as well as the overall stability of the market in the face of interest rate changes.

Average Prices and Target Rates:

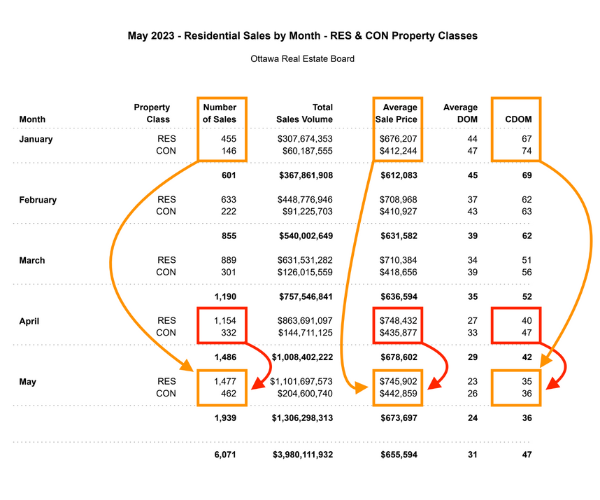

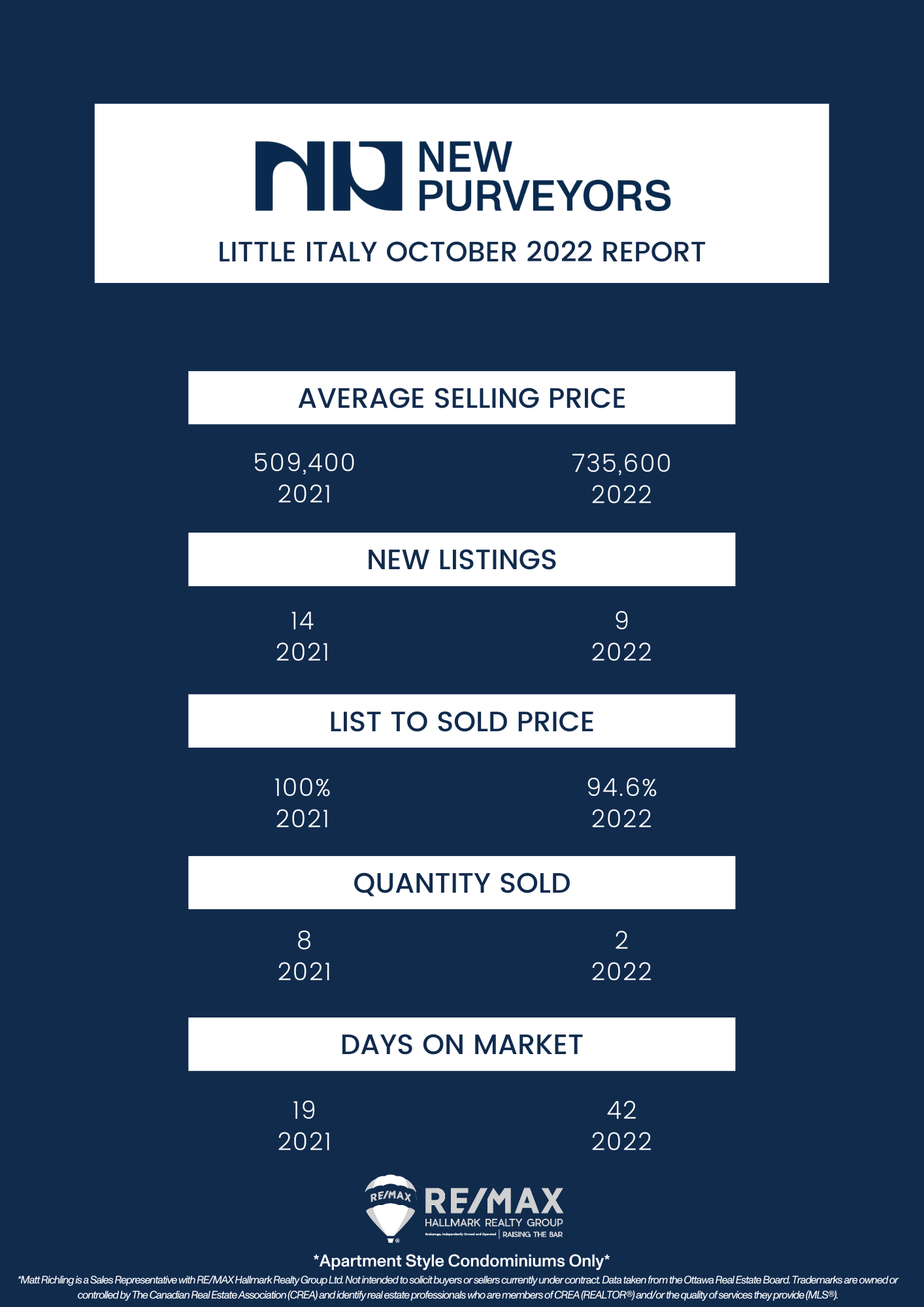

Comparing the average prices in May 2023 to previous months with varying target rates provides valuable insights into the current state of the Ottawa real estate market. Surprisingly, the average prices in May 2023, with a 4.5% target rate, closely resemble those seen in January 2022, when the target rate was a mere 0.50%. Furthermore, these prices are not far off from June 2022, when the target rate stood at 1.50%.

Market Resilience:

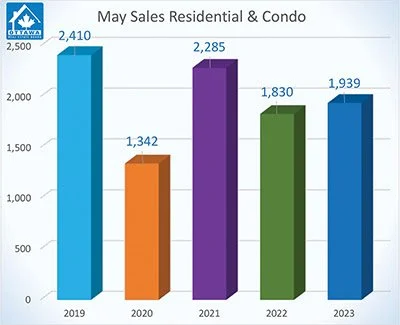

Despite the rate increases throughout 2023, the Ottawa real estate market has demonstrated resilience as prices have either increased or remained stable on a monthly basis. This stability can be attributed to various factors such as strong demand, limited supply, and the adaptability of buyers and sellers to changing market conditions.

Minimal Effect of Recent Increase:

On June 7th, a new interest rate increase of 0.25% was announced. However, it is anticipated that this adjustment will have a minimal effect on property values for both buyers and sellers. The reason behind this prediction lies in the fact that the market has already been operating under a 4.5% or higher target rate since January. Therefore, buyers and sellers have already adjusted their expectations and strategies accordingly.

Adaptation to Changing Rates:

It is worth noting that the majority of the interest rate increase occurred in the second half of 2022. Despite this significant change, people continued to move forward with their purchases and successfully adjusted to the new rates. This adaptability demonstrates the willingness of buyers and sellers to navigate changing conditions.

The Ottawa real estate market has proven its resilience in the face of fluctuating interest rates. Average prices in May 2023, despite a 4.5% target rate, mirror those observed in previous months with much lower rates. The market's ability to remain stable or experience growth month over month throughout 2023 indicates a sustained demand for properties in Ottawa. With the recent interest rate increase expected to have minimal impact, buyers and sellers can continue to navigate the market with confidence. As we move forward, the Ottawa real estate market appears poised for continued stability and growth.

Mitch MacKenzie

mitch@newpurveyors.com

613 282 9441