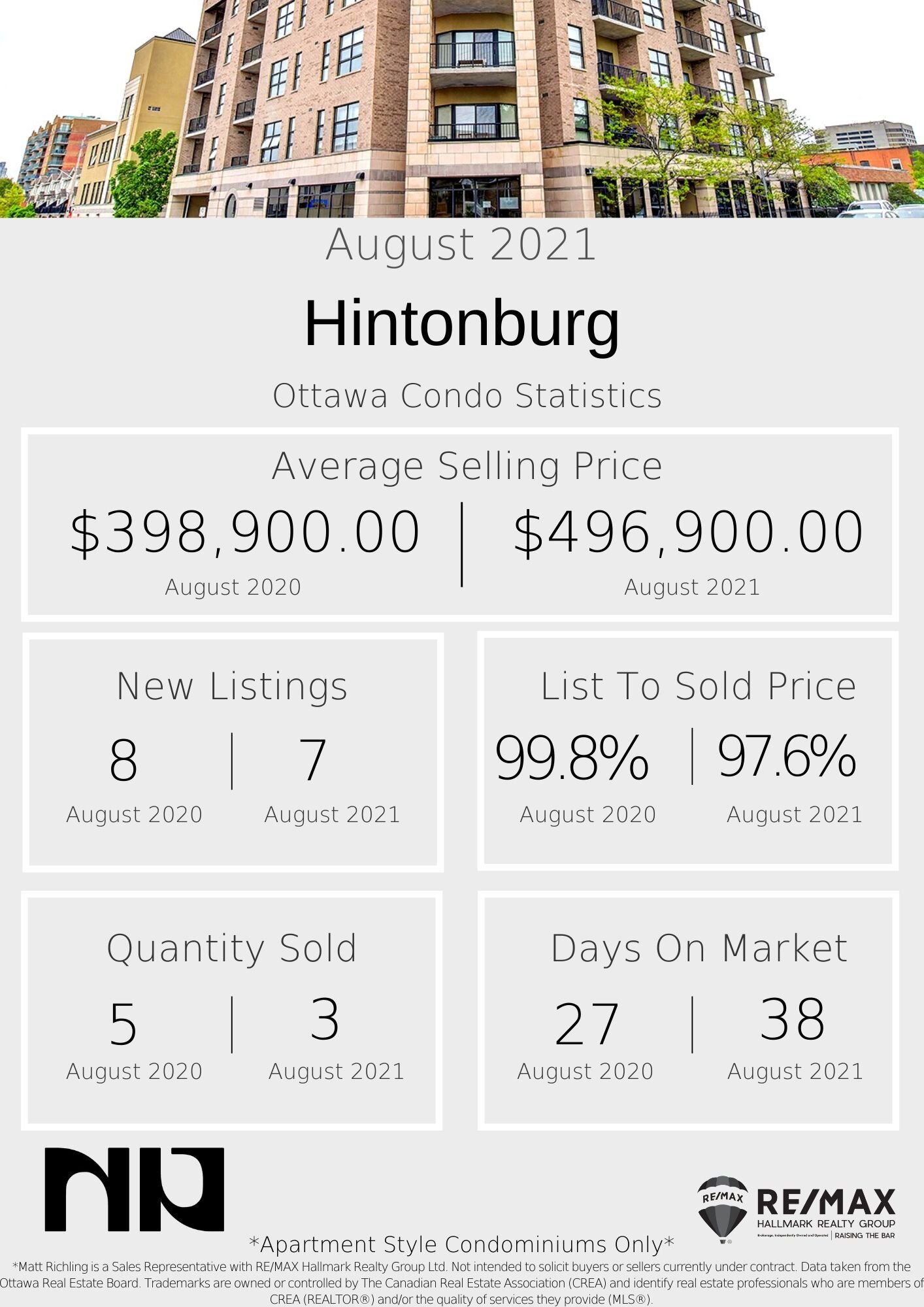

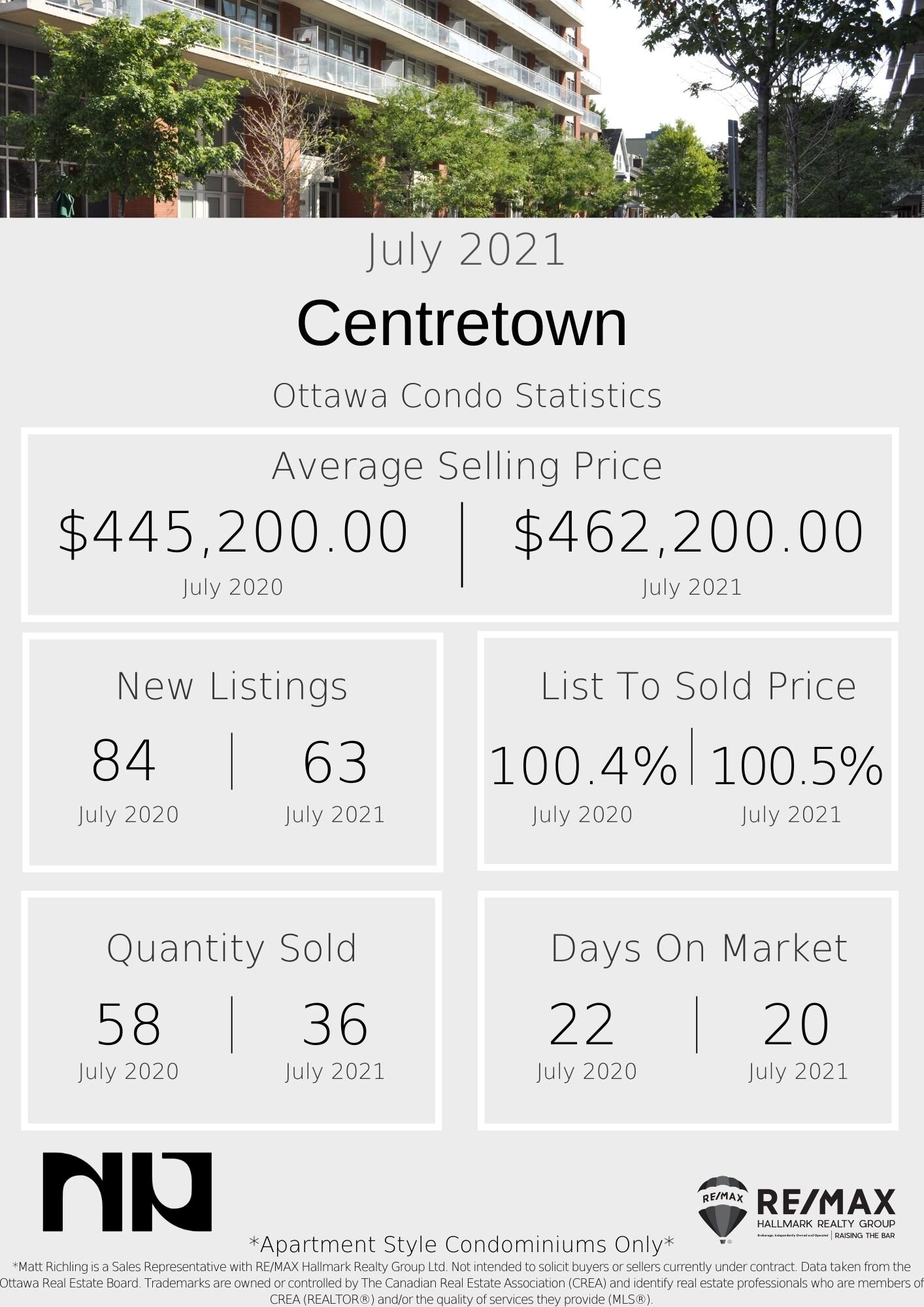

Every month we take a closer look and drill down the sales data of Ottawa condos from the previous month. Here are the statistics for August 2022 in the top five "downtown" areas - Centretown, Byward Market and Sandy Hill, Little Italy (which includes Lebreton Flats), Hintonburg, and Westboro. The information will be specific to apartment-style condominiums, and only what sold through the MLS. Also important to note that DOM (Day's On Market) is calculated to include the conditional period, which in Ottawa is roughly 14 days for almost every single transaction.

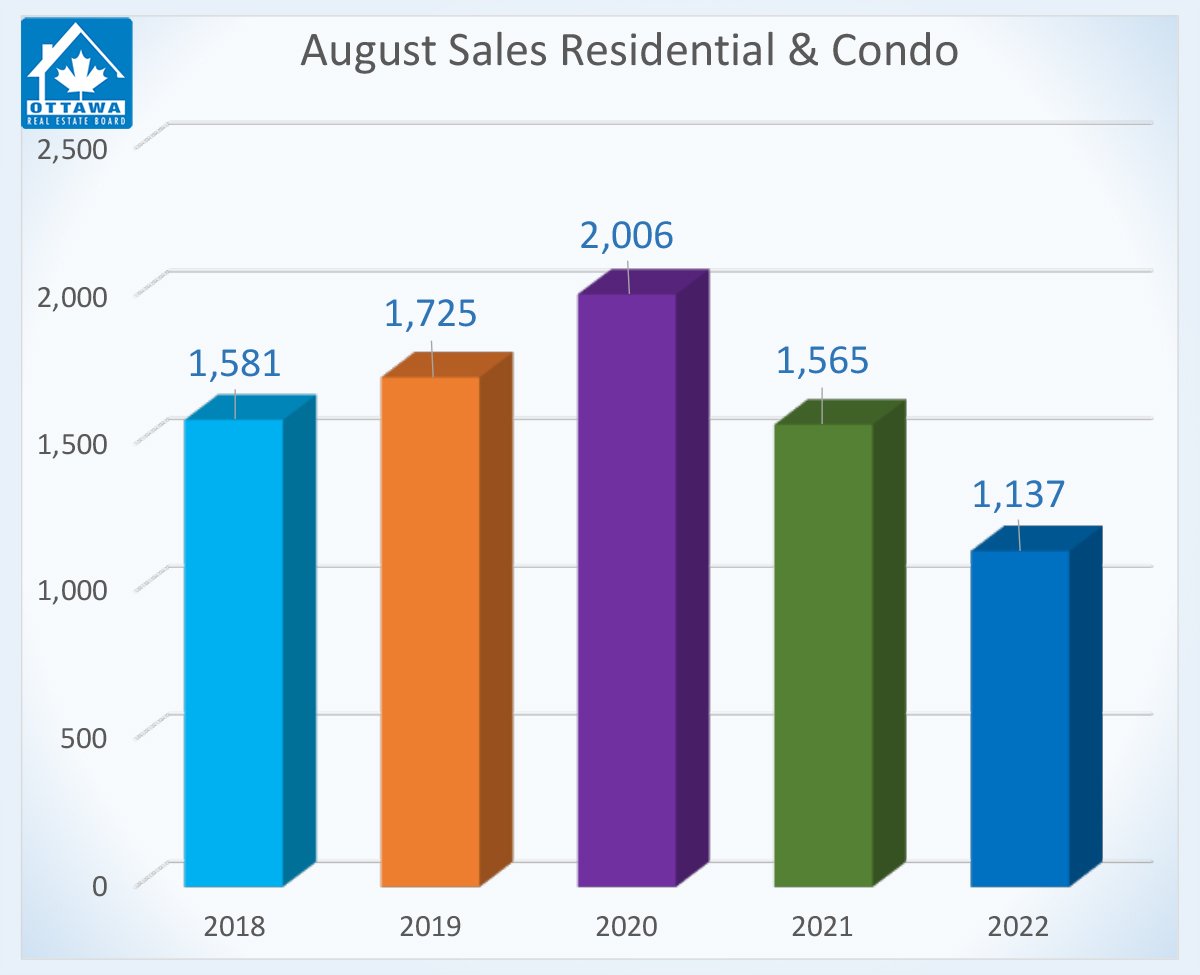

This month, the Ottawa Real Estate Board recorded 1137 residential real estate transactions, down 27% from 1565 in August 2021. This number is made up of 850 residential properties and 287 condominiums, decreases of 27-28% compared to this month last year. These numbers are also down significantly compared to the five-year average of 1600 sales.

The Ottawa Real Estate Board president, Penny Torontow, explains that August is traditionally a slower month in Ottawa for real estate due to summer vacations, school prep, and more. In addition, buyers are unsure about their ability to purchase homes, and at what budget, due to interest rate changes over the past few months.

The state of the market at the beginning of 2022 was unsustainable. As the market begins to slow, we can see the average days on market increasing, coming closer to 30 days. In addition, we’ve seen a return to the typical financing and inspection conditions on buyer contracts that were being skipped in order for buyers to make the most competitive offer. Homes are also seeing less multiple offer scenarios.

Condo prices are still increasing, up 4% from this month last year to an average of $421,966. Residential properties are also up 5% for an average of $707,712. Year-to-date, these numbers are even higher, up 9-10% at an average of $457,771 for condominiums and $795,978 for residential homes.

2,093 properties were listed this month, increasing our inventory to nearly 3 months for residential homes and 2.2 months for condominiums.

Torontow explains that prices are still high and rising, although the percent by which they are rising is getting smaller, down to the single-digit percentages now. We are moving towards a more balanced market, which means that buyers will have more choice and sellers will have to be more mindful about how they choose to price their properties.

Important to note is that these statistics can only be as accurate as there are condos sold in Ottawa. The more condos sold in an area, the more accurate the averages will be.

Want to chat about your options? Fill out the form at the bottom of the page, or text/call us directly 613-900-5700 or fill out the form at the bottom of the page.

Do you have any questions about how this information affects your investment or looking for more information to make the best decision about your purchase? Let’s chat! Fill out the form on the bottom of the page.