With the recent launch of Smart House Ottawa, and as more micro condo units are being built, buyers are excited for moving into these new spaces... However, if they can move in will be another storey. We are hearing rumours that banks and other lenders are not approving financing for these micro-condos.

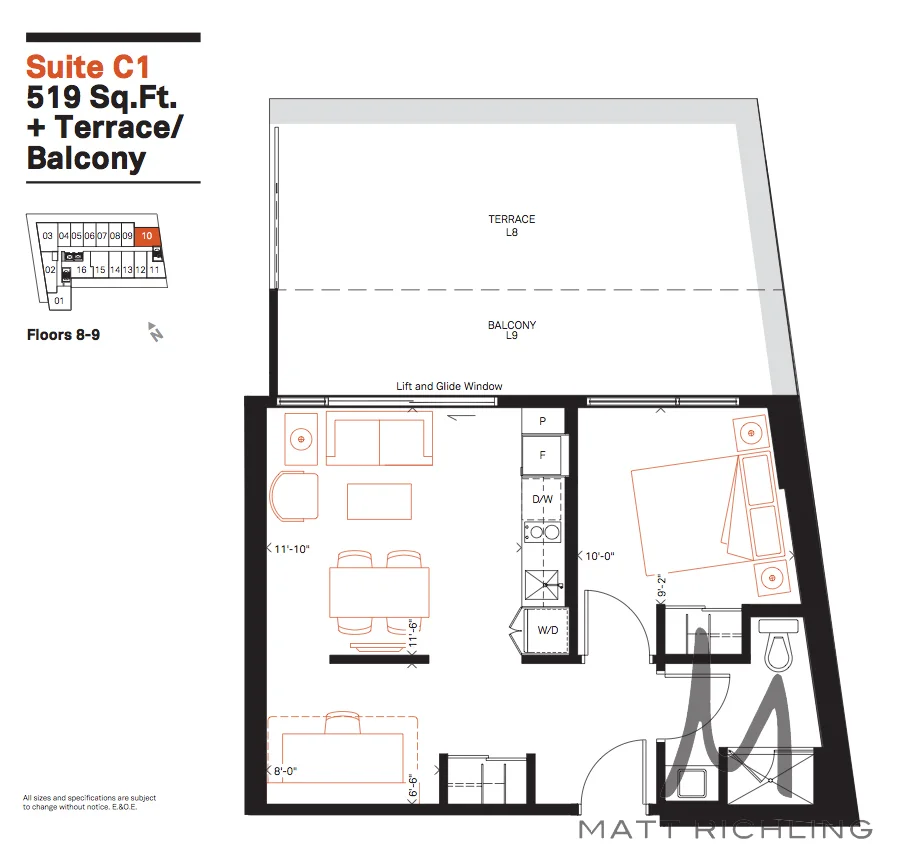

Representatives from the Big Five banks have all said they have rules on their financing policies that restrict approving mortgages that are under 500sqft. Up until the last few years, micro condos or bachalor studios were few and rare. With the shift in size, the lenders are being cautious and want to make sure they "understand" them.

While this policy for minimum size is a requirement, every application is reviewed on a case per case basis. I have sold multiple units over the past few years that are under 500sqft and a few dozen that were under 600sqft, all without size issues by the lender. While we have heard rumours here in Ottawa, we have not seen any first hand accounts where the mortgage was declined due to size.

So What Do I Do?

Before you sign the Agreement of Purchase and Sale, ensure you have a financing clause, and have consulted a mortgage broker. Make sure they have the green light before moving ahead with the purchase and that they have the correct sqftage. Last thing you want is an issue on closing day.

Examples of Small Units in Ottawa?

There are two units per floor inside Mondrian (324 Laurier Ave at Bank, 2009) that are under 500sqft and another three units that are under 600sqft. The East Market (180 York, 383 Cumberland, 179 George, 2001-2007) has six units per floor that are under 500sqft, and another eleven per floor that are or under 600sqft.

Are you looking to buy or finance a micro condo and want some help? I would love to chat...

Written by Matt Richling

Matt is a licensed salesperson at RE/MAX Metro City Realty in Ottawa, Canada. Matt loves helping sellers and buyers find the perfect home that fits their lifestyle.